child tax credit 2021 dates and amounts

It also provided monthly payments from July of 2021 to. 2021 Child Tax Credit payments are available to all caregivers.

Child Tax Credit 2022 You Might Have Received An Incorrect 6419 Letter Irs Warns Lee Daily

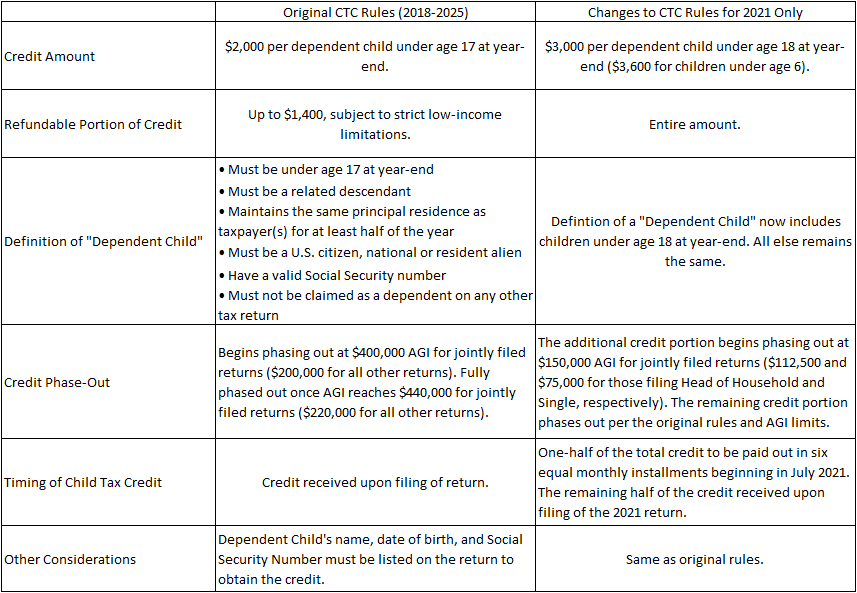

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600.

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

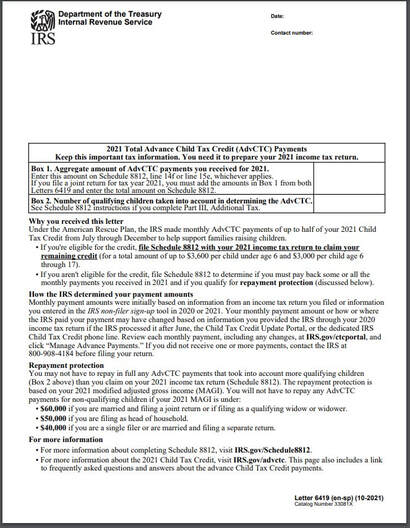

. The expanded credit is for tax year 2021. Visit ChildTaxCreditgov for details. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only.

The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. New 2021 Child Tax Credit and advance payment details. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

If the amount of the credit exceeded the tax that was. 15 opt out by Aug. Here are the official dates.

Child Care Tax Credit Calculator 2020 LAM BLOGER from ess3usuariosepsinfo. First the credit amount was temporarily increased from 2000 per child to. 13 opt out by Aug.

2022In 2020 eligible taxpayers could claim a tax credit of 2000 per qualifying dependent child under age 17. Individuals that make less than 12550 and married couples that make less than 25100 can file through. The credit reverts to previous amounts in 2022.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. Your amount changes based on the age of your. The IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit to parents of children up to age five.

You file as head of household on your 2020 tax return with a dependent that was 17 in 2020 AGI income of 60000 and you receive the advance Child Tax Credit. Treatment in the National Income and Product Accounts NIPAs Refundable income tax. That comes out to 300 per month through the.

On October 19 2021 the Texas Workforce Commission TWC approved distribution of 245 billion American Rescue Plan Act funds for. 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C. Tax season is far from over.

Calculation of the 2021 Child Tax Credit Earned Income Tax Credit Businesses and Self. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600. The Child Tax Credit and Earned Income Tax Credit.

The two most significant changes impact the credit amount and how parents receive the credit. To get the full enhanced CTC which amounts to 3600 for children under 6 years old and 3000 for kids ages 6 to 17 years old single taxpayers must earn less than. The first phaseout reduces the Child Tax Credit by 50 for each 1000 or fraction thereof by which the taxpayers modified AGI exceeds the income amounts above.

For 2021 you can deduct a maximum of 8000 of expenses for one child or dependent or 16000 for two or. The tool below is to only be used to help you determine what your 2021. If you had a newborn or adopted any children in 2021 you will receive the full amount when you file your.

Child Tax Credit amounts will be different for each family. The payments will be made either by direct deposit or by paper check depending on what. The credit amounts will increase for many.

The advance Child Tax Credit payments were signed into law as a part of the American Rescue Plan Act in 2021. Dates for earlier payments are shown in the schedule below. Good news - Child Care Relief Funding 2022 is here.

Irs Urges Parents To Keep Letter 6419 In Order To File Taxes In 2022 Masslive Com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Adv Child Tax Credit Cwa Tax Professionals

Dependent Children 2021 Tax Credit Jnba Financial Advisors

Elm3 S Guide To The 2021 Child Tax Credit Tax Accountant Financial Planner

Here S Who Qualifies For The New 3 000 Child Tax Credit

2020 Tax Filing Will Determine Child Tax Credit Periodic Payments In 2021 Early Childhood Alliance

Inworks Tax Services Advanced Child Tax Credit Ctc Payments In 2021 The First Monthly Payment Of The Expanded And Newly Advanceable Ctc Will Be Made On July 15 Eligible Families Are Slated

American Rescue Plan 2021 Tax Credit Stimulus Check Rules

Irs Warns Parents Not To Toss Important Tax Document

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Monday Is Last Day To Sign Up For Child Tax Credit If You Have Not Received Payments In The Last Six Months

Child Tax Credit Changes Weigh The Benefits Vs Impact On Your Tax Liability Grf Cpas Advisors

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Update Missed First Payment Youtube

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Tax Credit 2021 Why Opt Out Of Monthly Payments Money

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep